"The Psychology Behind Copy Trades: Understanding the Mindset of Successful Traders" - An Overview

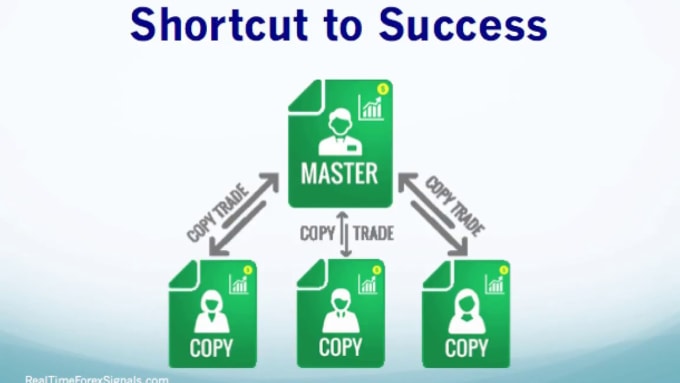

Mirror investing, additionally recognized as duplicate trading, has got substantial level of popularity in the financial markets in latest years. This innovative approach enables traders to duplicate the profession of experienced financiers, enabling them to likely profit coming from their experience and success. For those brand-new to mirror trading, understanding this approach can easily be challenging. However, along with a couple of vital suggestions for excellence, investors can significantly enhance their odds of achieving successful outcome.

To begin with and foremost, it is essential to select a reliable mirror exchanging platform. With countless systems readily available in the market, picking one that match your demands and lines up with your objectives is essential. Look for a platform that offers a vast variety of successful traders to duplicate from and provides transparent info regarding their efficiency past history.

Once you have chosen a suited mirror investing system, it is significant to administer in depth analysis on the traders you plan to copy. Examine copygram.app of report and assess their previous functionality in different market disorders. Pay for focus to aspects such as victory cost, ordinary earnings per business, maximum drawdowns, and congruity over opportunity.

Variation is an additional key component of successful mirror trading. By copying various traders around several asset classes or strategies, you can spread out your danger and potentially improve your odds of profits. Stay clear of putting all your eggs in one basket through diversifying your collection with duplicating different styles of investors who concentrate in several markets or work with unique investing approaches.

Threat control need to be at the forefront of any kind of investor's thoughts when engaging in mirror trading. It is essential to specified ideal danger criteria that line up along with your threat tolerance and financial goals. Many mirror exchanging platforms supply resources such as stop-loss orders or placement sizing choices that enable you to regulate the volume of capital at danger every profession or overall collection direct exposure.

In addition, carefully checking the functionality of the investors you are duplicating is critical for effectiveness in mirror investing. Keep an eye on their business and respond immediately if any sort of unanticipated variances happen from their normal strategies or if they experience a long term losing streak. Routinely analyze the functionality of your copied investors and be prepared to help make modifications if necessary.

Patience is a quality when it comes to mirror investing. Avoid the appeal to continuously change between various traders in search of short-term increases. Always remember that prosperous trading needs style and a long-term viewpoint. Offer your picked investors sufficient time to showcase their skills and make it possible for for prospective market fluctuations just before producing any type of hasty choices.

Furthermore, it is important to remain informed about the newest market developments and styles. Keep abreast of information that might affect the monetary markets and the methods hired by your replicated investors. Through staying informed, you may much better recognize their decision-making method and foresee prospective changes in their exchanging approach.

Lastly, it is important not to rely only on mirror exchanging as a easy expenditure strategy. While duplicating effective investors can be favorable, it is still important to gain know-how regarding monetary markets and build your own understanding of investing principles. Educate yourself through reading books, attending webinars or seminars, or also taking into consideration registering in trading training programs.

In final thought, learning copy trades via mirror exchanging demands mindful consideration and faithfulness to certain guidelines. Selecting a reliable platform, administering significant investigation on possible investors to duplicate, transforming your portfolio, taking care of risk effectively, keeping an eye on performance very closely, engaging in perseverance, remaining updated concerning market trends, and proceeding personal education and learning are all necessary steps in the direction of obtaining success in mirror investing. By following these pointers carefully, you may boost your opportunities of profiting from this impressive form of investment strategy.

Keep in mind: Total phrase count: 570 phrases